Acquisition project | Jiraaf

1.Product Flow

About Jiraaf:

A.1. Problem Statement

- As income levels are rising, individuals are looking for investing opportunities

- Currently, Equity is the dominant asset class where individuals can invest but the asset class has short-comings:

- Equity is linked to market risk and is very volatile

- Same expected return can be earned with lesser risk if the portfolio is well diversified across asset class

- Available financial instruments for an individual to take exposure in fixed income is through FDs and the FD returns don't beat inflation

- There are a lot of high yielding fixed income instruments with flexibility with regards to tenure that are only available to HNIs / Family Offices / Institutions

A.2 Jiraaf's Proposition

Enabling investing in Fixed Income securities yielding 6-20% returns with tenures ranging from 3 months to 3 years with minimum ticket size of INR 1,000

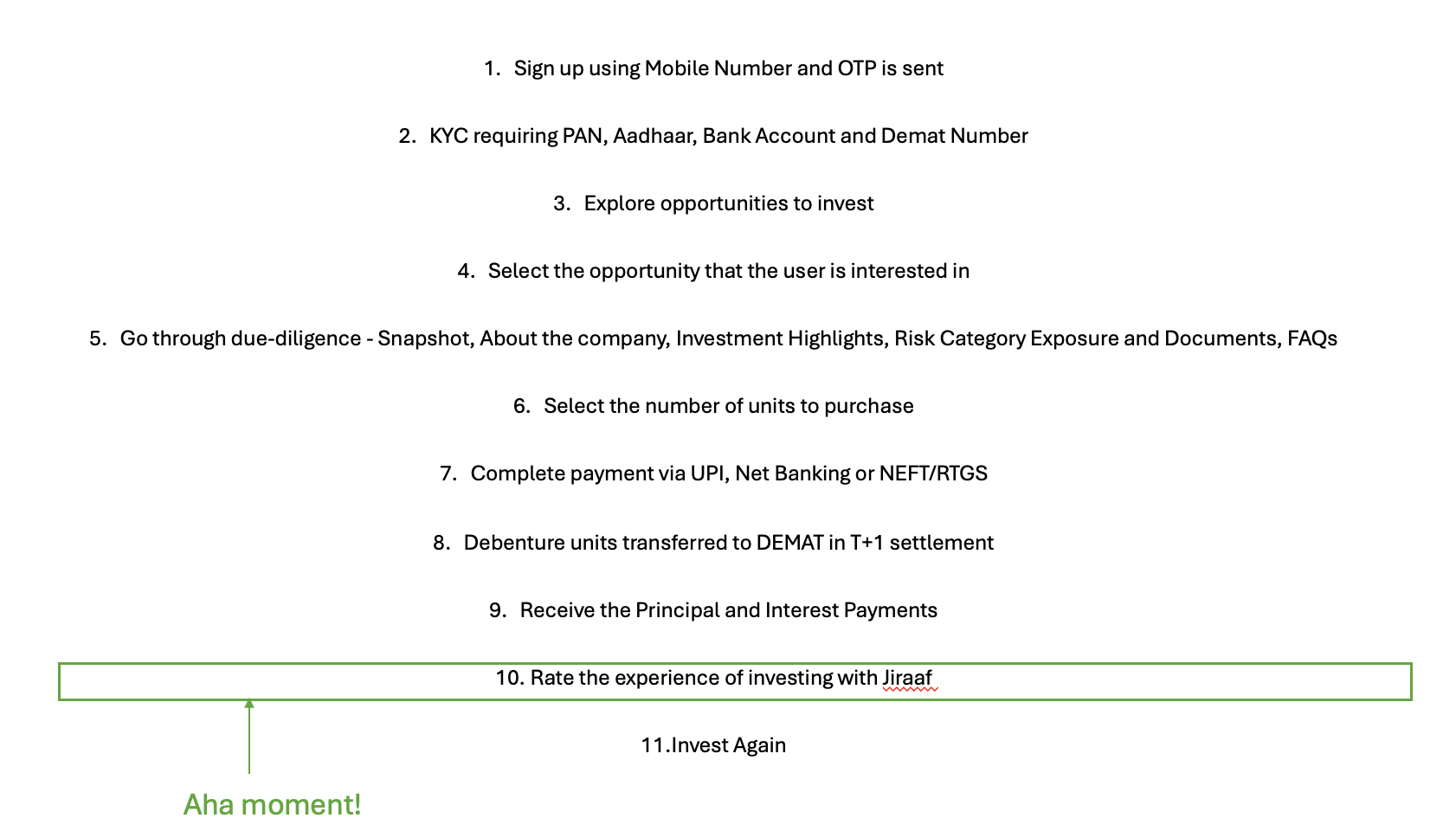

B. Understand the product flow across platforms

- Website accessed through iOS and Browser (both Computer and Phone)

- App for iOS and Android for altJiraaf

- Sign up using Mobile Number and OTP is sent

- KYC requiring PAN, Aadhaar, Bank Account and Demat Number

- Explore opportunities to invest

- Select the opportunity that the user is interested in

- Go through due-diligence - Snapshot, About the company, Investment Highlights, Risk Category Exposure and Documents, FAQs

- Select the number of units to purchase

- Complete payment via UPI, Net Banking or NEFT/RTGS

- Debenture units transferred to DEMAT in T+1 settlement

C. Screenshots of Marketing ad

D. Reviews

Google: 103 reviews with a 4.4/5.

- Good Reviews

- Almost everyone has had a very good experience with their respective relationship manager. Sucheta and Sheetal have been mentioned quite a few times

- Great source for Passive income

- Flexibility in terms of Risk profile and tenure

- Simple and Smooth Experience

- Poor reviews:

- 1* -> 6-7 securities got defaulted

- Folks confused about the change of Jiraaf to AltGraaf

- New company

E. ICP

Parameters | ICP 1: Young Adults | ICP 2: Family Offices/ HNIs |

|---|---|---|

Social Media | Linkedin, Instagram | Linkedin, Instagram |

Income | 25L > | 5Cr > |

Age | 28 - 40 | 25 - 50 |

Education | Tier 1/2 University Undergrad Tier 1/2 University MBA | Tier 1/2 University Undergrad Tier 1/2 University MBA |

Geography | Metro | Metro, Tier 1/2 Cities |

Risk Appetite | High | Medium to High |

Single / Married | Single | Married |

Moved to new city | Yes | No |

Profession | Startups, MNCs, Corporates | Managing Family Office as a CIO or part of the Family |

Read / Listen / Watch | Podcasts (FIRE), Business News, Memes, Standup Comedy | Business and Political News, Linkedin Articles, Self Help Books, Motivation Videos, Whatsapp Broadcasts |

Who do They follow? | Fin-fluencers - Ankur Warikoo, Shantanu Deshpande, Nikhil Kamath Comedians: Tanmay bhatt, Bassi, Kullu, Raunak Rajani | Finfluencers: Ankur Warikoo, Kunal Shah, Shraddha Sharma, Sharan Hegde, Kiran Mazumdar Shaw |

Influencer | College/School Friends, Colleagues | Other Family Offices |

Blockers | Partner, Parents | Patriarchs |

Pain Points |

besides equity markets

securities but only have Fixed Deposits to invest which yield low returns (barely) beat inflation

don't have a platform through which they can invest

Passive Income

understand. Requires a lot of effort and hence, prefer seeking advise from family/friends |

Traditionally, driven by Bankers, experience is fragmented and opaque, monitoring, and exiting fixed-income instruments.

Investment in Alternate Investments exposure, is primarily through PE/VC - often suffer from illiquidity, opacity and difficulty in driving exits.

Despite FOs having large corpuses, investments in traditional asset classes, such as equity and commodities, can create cashflow issues for FOs |

Will be prioritising ICP 1: Young Adults since:

- Onboarding Young Adults is far quicker (< 3 days) vis-a-vis Family Offices (6-9 months)

- Number of Young Adults are far higher than Family Office and hence more scalable

3.Competition

Startup Name | Wint Wealth | Stable Money | Grip Invest |

Stage | Series A | Series B | Series B |

Security Offering | Corporate Bonds + FDs | Corporate Bonds + FDs | Corporate Bonds, Invoice Discounting, Asset Leasing, RBF |

IRR Returns | 5-11% | 6-11% | |

Youtube Subscribers | 432k | 1k | 5.5k |

Instagram Subscribers | 37k | 1k | 22.6k |

Linkedin Subscribers (Company, Founders) | 42k, 100k | 24k, 55k | 32k, 25k |

SEO | Poor | Poor | Good |

Investors | 3one4, EightRoads, Arkam,Blume, Zerodha, Rainmatter, Gemba | Matrix, Lightspeed, Titan Capital | AdvatEdge, Venture Highway, Gemba Capital |

Funding | $23Mn | $10Mn | $14Mn |

A. Strengths

- Wider offering of securities with respect to

- Strong diligence of securities as the founder's come from Securities background

B. Weakness

- Little/No engagement on Social Media and Youtube

- Lower ranked on SEO

- No app for Jiraaf investing vis-a-vis all competitors

4.Market

- TAM: INR 6Tn

- # Active Demat Accounts: 150Mn

- Investment / Demat Account: INR 0.2Mn

- Investing in Fixed Income: 30%

- SAM: INR 3Tn (10% of TAM)

- SOM: INR 700 Bn

- Retail: INR 100Bn

- 1% of the total # Active Demat Accounts: 1.5Mn

- Investment / Demat Account: INR 0.2Mn

- Investing in Fixed Income: 30%

- HNI / Family Office: 600Bn

- Family Office: INR 500Bn

- Total Family Offices with > INR 5Bn Liquid Wealth: #500

- % Allocation to Fixed Income: 20%

- Investment / Family Office: 1Bn

- HNI: INR 100Bn

- Total # HNIs with Liquid Wealth 100Mn - 500Mn: #1,000

- % Allocation to Fixed Income: 30%

- Investment / HNI: 100Mn

Core Value Proposition:

ICP 1: Invest in a range of fixed Income securities to earn passive income and grow wealth

ICP 2: Invest in high yielding alternative investment asset class to earn high returns at portfolio and manage cashflows through a tech platform

5.Experiments

Jiraaf is currently in Early scaling stage and hence, have chosen Referral Program for Retail Investors (ICP 1), Content Loop and Partnership Program for HNI/Family Office Investors (ICP 2).

Experiment 1 (ICP 1): Referral Program

- Brag Worth: Opportunity to generate passive income

- Platform Currency: Jiraaf investing on behalf of the user

- Who will you ask for a referral?: Refer a friend and get access to

4. How will they discover it?

Discover this when they have given a 5 star rating.

5. Why will they refer?

a. Money: INR 1,000 will be invested by Jiraaf in their next investment on successful Referral. Successful referral will be defined as investing INR 1,000 with Jiraaf by the refereee

b. Access: Access to Senior RM and Exclusive Investing Opportunities on completing of 10 successful referrals

6. How will they share?

Share it through Whatsapp because that is where most of their colleagues hang out

a. 1:1 -> Share it through Whatsapp to their colleagues and school/college friends

b. 1:few -> Share it through Whatsapp on groups

7. How will they track?

Dashboard on the app tracking the status of each referrer. The dashboard to include:

a. Status of the referee: Signed up, KYC registered, Investment made

b. Nudge the referee: option to send a whatsapp message from the dashboard itself

8. How will they keep referring?

a. Identify users that have referred atleast 1 user

b. Staggered referral program:

- > 5 successful referrals, get access to a Senior RM and exclusive opportunities to invest

- > 15 successful referrals, get the iPhone 13

- > 25 successful referrals, get Macbook Air

Experiment 2 (ICP 2): Partnership program with IFA

- Identify IFAs through available databases and reach out to them by an BD executive

- The BD executive should emphasise their pitch on: Enable the IFA to differentiate themselves from other IFAs by giving access to financial products that the clients don't have

- BD to invite IFAs to an in-person conference where at a 5star hotel banquet for an in-person education about Jiraaf's product offering, taxation and return expectations (important because IFAs don't usually get invited to these)

- IFAs to be incentivised

Experiment 3 (ICP 2): Family Office Content Loop

- Content Loop: Content to be created in the form Newsletters

- Users in this case are CIOs or Patriarchs of the Family Office. They Spend 30-60 mins everyday on Newsletters reading about investing opportunities and educating themselves.

- Core Tenants of Content Loop:

- Hook: Earn high returns through Alternate Fixed Income Securities

- Generator: Jiraaf Content Team

- Distributor: Jiraaf's Email List

Brand focused courses

Great brands aren't built on clicks. They're built on trust. Craft narratives that resonate, campaigns that stand out, and brands that last.

All courses

Master every lever of growth — from acquisition to retention, data to events. Pick a course, go deep, and apply it to your business right away.

Explore courses by GrowthX

Built by Leaders From Amazon, CRED, Zepto, Hindustan Unilever, Flipkart, paytm & more

Course

Advanced Growth Strategy

Core principles to distribution, user onboarding, retention & monetisation.

58 modules

21 hours

Course

Go to Market

Learn to implement lean, balanced & all out GTM strategies while getting stakeholder buy-in.

17 modules

1 hour

Course

Brand Led Growth

Design your brand wedge & implement it across every customer touchpoint.

15 modules

2 hours

Course

Event Led Growth

Design an end to end strategy to create events that drive revenue growth.

48 modules

1 hour

Course

Growth Model Design

Learn how to break down your North Star metric into actionable input levers and prioritise them.

9 modules

1 hour

Course

Building Growth Teams

Learn how to design your team blueprint, attract, hire & retain great talent

24 modules

1 hour

Course

Data Led Growth

Learn the science of RCA & experimentation design to drive real revenue impact.

12 modules

2 hours

Course

Email marketing

Learn how to set up email as a channel and build the 0 → 1 strategy for email marketing

12 modules

1 hour

Course

Partnership Led Growth

Design product integrations & channel partnerships to drive revenue impact.

27 modules

1 hour

Course

Tech for Growth

Learn to ship better products with engineering & take informed trade-offs.

14 modules

2 hours

Crack a new job or a promotion with ELEVATE

Designed for mid-senior & leadership roles across growth, product, marketing, strategy & business

Learning Resources

Browse 500+ case studies, articles & resources the learning resources that you won't find on the internet.

Patience—you’re about to be impressed.